Why Bitcoin Matters: Understanding Its Value Beyond Price

Bitcoin is often viewed simply as an investment asset, but its importance goes well beyond price speculation. As a decentralized system, Bitcoin offers a new model of value—one based on financial freedom, technological innovation, and global inclusion. Let’s explore why Bitcoin matters at its core.

Decentralized Money and Financial Sovereignty

Bitcoin operates without central authorities—no banks or governments control issuance or transactions. This decentralization empowers people to self-custody their wealth, bypass censorship, and operate independently, especially in regions where financial systems are restricted or unstable.

Digital Store of Value

With a fixed supply capped at 21 million coins, Bitcoin offers scarcity similar to rare metals. This makes it a “digital gold” hedge against inflation and monetary policy risks. While volatile in the short term, its design aims to preserve purchasing power over decades.

Financial Inclusion and Cross-Border Access

Millions worldwide lack access to traditional banking. Bitcoin only requires internet access and a digital wallet—no account approval, no geolocation restrictions—a lifeline for the unbanked. Cross-border remittances also become faster and cheaper using Bitcoin.

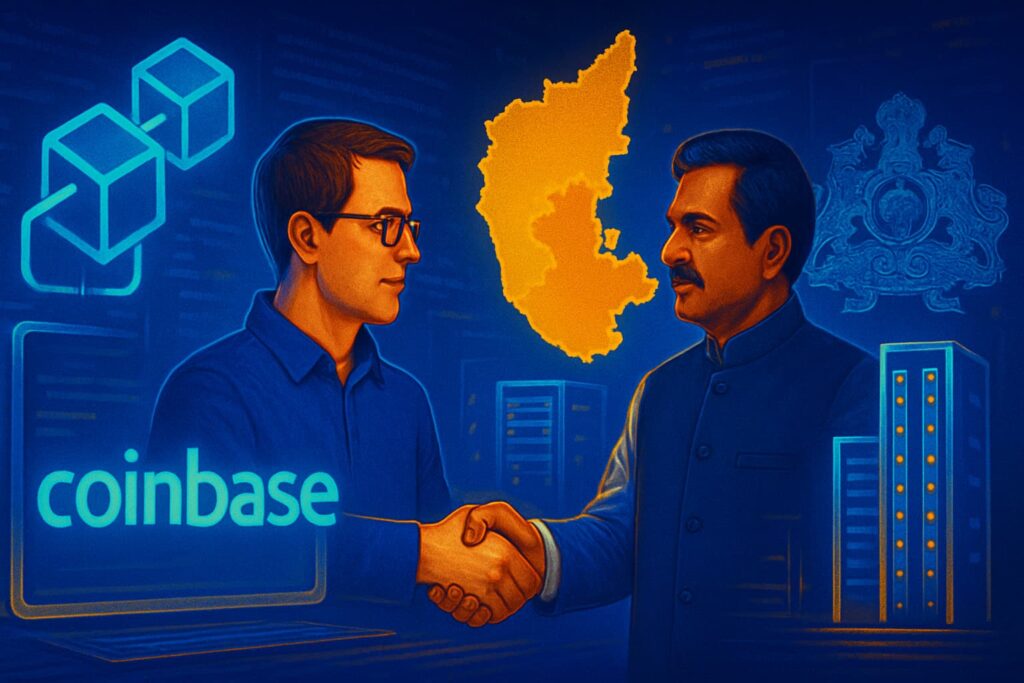

Innovation and Financial Infrastructure

Bitcoin introduced blockchain technology and smart contracts built on its network extensions. It inspired Layer-2 scaling solutions, Lightning Network payments, and new models of decentralized finance (e.g., Bitcoin-backed lending, tokenization). Its open ecosystem drives broader technological development.

Censorship Resistance and Privacy

Bitcoin’s design ensures censorship-resistant value transfer. No authority can block or reverse transactions. While Bitcoin is pseudonymous (not fully anonymous), combining it with privacy tools offers users financial privacy without dependence on intermediaries.

Real-World Use Cases and Institutional Adoption

Governments, firms, and funds are increasingly holding Bitcoin as part of treasury reserves or institutional portfolios. Payment processors, remittance firms, and fintech startups integrate Bitcoin to enhance trust, reduce costs, and enable programmable value. This gradual adoption reinforces Bitcoin’s role beyond speculative trading.

Summary

Bitcoin’s value extends far beyond price swings. With decentralized architecture, monetary policy built on scarcity, global accessibility, and innovation leadership, Bitcoin serves as a powerful tool for financial empowerment and infrastructural progress. Recognizing its broader purpose helps frame it not just as an asset—but as a movement toward a more open, global financial future.