Altcoins Rally Ahead as Bitcoin Faces Resistance in Narrow Trading Range

The crypto market is witnessing a shift in momentum as altcoins take the lead, while Bitcoin (BTC) continues to trade sideways. Despite several attempts, Bitcoin has failed to break past its key resistance, giving way for alternative cryptocurrencies to shine.

Bitcoin Struggles at Resistance Around $119K

Bitcoin is currently trading within a narrow range of $115.6K to $119.5K, according to analyst Michaël van de Poppe. The repeated rejections at the top of this zone reflect growing indecision in the market.

A breakout above $119.5K could set the stage for a new bullish wave, possibly testing all-time highs. However, if BTC loses support at $115.6K, it may drop toward the $110K–$112K zone, which could act as a buyer-friendly accumulation area.

The lower part of this range holds significant liquidity, making it a prime target for potential sweeps. If Bitcoin dips sharply, it could send shockwaves across the market—especially for altcoins, which tend to react with even more volatility.

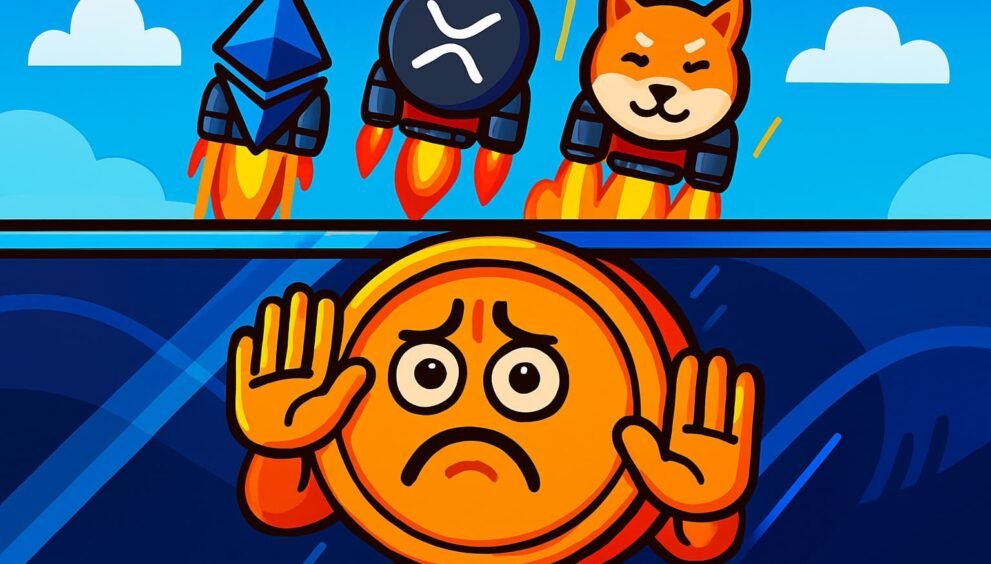

Altcoins Rally on High Leverage and Strong Sentiment

While Bitcoin remains in a holding pattern, altcoins are soaring. According to Ether Wizz, open interest in major altcoins like Ethereum (ETH) and Ripple (XRP) has hit a record $45 billion since early July.

This surge in leverage suggests a rising appetite for risk, with traders increasingly favoring altcoins over Bitcoin.

In a significant development, Ethereum’s perpetual futures volume has surpassed Bitcoin’s for the first time since 2022, indicating a growing shift in trader behavior.

Meme Coins, DeFi, and AI Tokens Outperform

Sectors like AI tokens, DeFi projects, gaming cryptos, and even meme coins have delivered higher returns than Bitcoin over the past week.

Meanwhile, long-term ETH holders are standing firm. According to on-chain data, Ethereum’s cost basis heatmap shows solid accumulation above $2,400, reflecting long-term confidence.

However, this also raises caution: if the market turns, a quick drop from these levels could trigger sudden volatility and long liquidations.