How News Affects Crypto Prices: A Step-by-Step Guide for Beginners

In the crypto market, news moves prices—fast. Whether it’s a government announcement, a big partnership, or a regulatory crackdown, news can send coins soaring or crashing within minutes.

If you’ve ever wondered why prices suddenly spike after a tweet or why your portfolio tanks after a headline, this guide will explain exactly how news affects crypto prices—in simple, step-by-step terms.

Why News Matters in Crypto

Unlike traditional assets, crypto operates in a 24/7 global market, and it’s highly reactive to sentiment and speculation. This makes news one of the most powerful price drivers.

Here’s why:

- No centralized regulation: News is often the only insight into future regulations or policies.

- Speculation-based value: Many crypto assets trade on hype, community trust, or trends.

- Fast-moving retail market: Millions of users act on headlines instantly using apps and bots.

Let’s break down the process of how a single piece of news can impact price.

Step 1: News Is Released

This could be:

- A government announcement

- A celebrity endorsement

- A security breach

- An exchange listing or delisting

- A crypto protocol upgrade

- Macroeconomic news (inflation, interest rates, etc.)

Example:

Elon Musk tweets “We now accept Dogecoin for Tesla merch.”

Result: The news spreads instantly, making DOGE trend across platforms.

Step 2: Market Sentiment Changes

News affects trader psychology. The market quickly interprets the headline as:

- Bullish (positive) → Prices rise

- Bearish (negative) → Prices drop

- Neutral → Minimal impact

This shift happens within seconds to minutes, especially with breaking news on Twitter or Telegram.

Example:

A rumor spreads that the SEC may approve a Bitcoin ETF.

Traders rush to buy BTC, expecting price growth.

Step 3: Buying or Selling Pressure Increases

As sentiment shifts, large volumes of traders (and bots) start buying or selling:

- Positive news = buying pressure → prices spike

- Negative news = selling pressure → prices crash

This rush creates volatility. Often, whales (big holders) will use these reactions to move markets further.

Step 4: Technical Indicators React

Volume spikes, RSI jumps into overbought/oversold zones, and price breaks key levels.

- Breakouts from chart patterns happen faster

- Traders adjust stop losses and take-profits

- Algorithms detect and trade based on news sentiment

At this stage, news is now built into the chart, influencing TA decisions too.

Step 5: Price Stabilizes or Retraces

After the initial spike or dip:

- If the news is confirmed and strong, prices may trend in the same direction

- If the news is overhyped or false, prices may correct sharply

This is when experienced traders assess whether to stay in the trade or exit.

Example:

A token pumps 60% on fake partnership news, then crashes 40% when the truth comes out.

How Different Types of News Affect Prices

Positive News (Bullish)

- Institutional investment (e.g., BlackRock, Tesla)

- ETF approvals

- Exchange listings (Coinbase, Binance)

- Successful project upgrades

- Major brand partnerships

Usually leads to price increase and higher trading volume.

Negative News (Bearish)

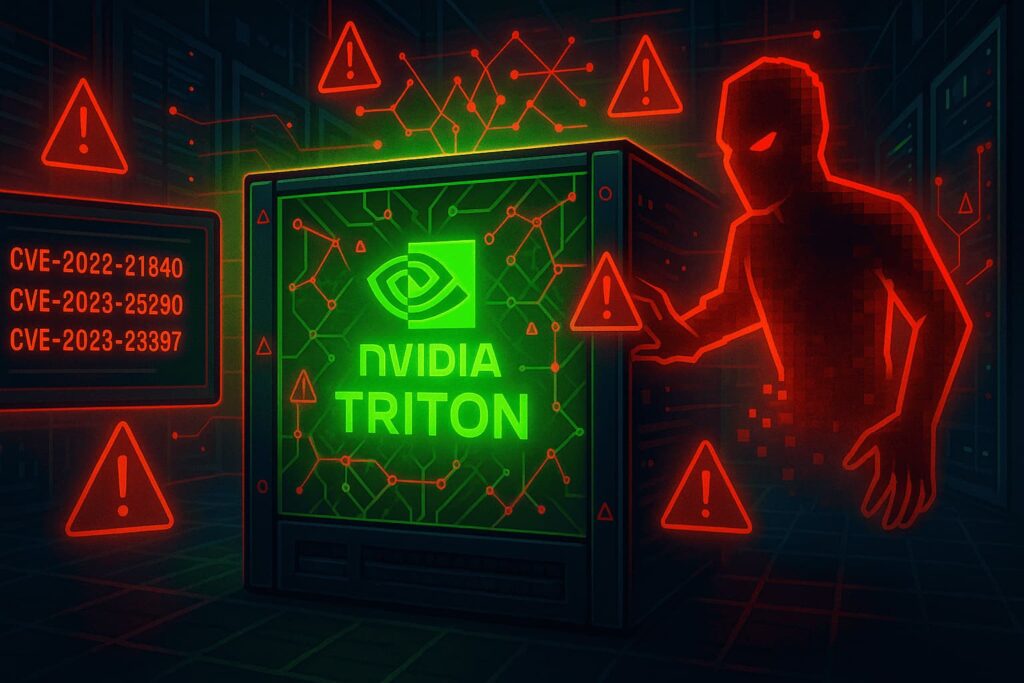

- Hacks or security breaches

- Regulatory crackdowns

- Delistings from exchanges

- Rug pulls or scams

- Bearish macroeconomic data

Often causes panic selling and sharp price drops.

How to React to News as a Trader

Here are some practical tips:

- Stay informed in real time

Follow trusted sources like CoinDesk, The Block, Twitter (X), and Telegram channels. - Avoid FOMO trading

Don’t buy just because others are. Wait for confirmation. - Use stop-loss orders

Protect your capital during volatile reactions. - Confirm news before acting

Check multiple sources. Scams often spread fake hype. - Watch sentiment tools

Platforms like LunarCrush or Santiment track market mood in real time.

Real-World Examples

Positive News:

- July 2024: Bitcoin ETF gets approved in the U.S.

→ BTC price jumps from $36,000 to $48,000 within weeks.

Negative News:

- 2022: FTX exchange collapses

→ Massive panic causes BTC to fall from $21,000 to $15,500 in days.

These examples show how news—good or bad—can reshape the entire market.

Summary: News Is the Fuel of Crypto Volatility

In crypto, news acts as the spark that ignites price movement. Understanding how to interpret and respond to news can make the difference between profit and loss.

Whether you’re a day trader or long-term HODLer, mastering the news-price connection is key to staying ahead in the game.

Stay informed. Stay cautious. And always think before you trade.